Renewable Energy Sources lead to reduced electricity costs in Greece

There has recently been widespread concern that electricity pricing in Greece is considerably higher than energy pricing in Europe as a result of Renewable Energy Sources.

This view claims that Greek consumers, households and businesses bear a “heavy cost” which among other things undermines the country’s growth potential.

To solve the issue, a fast application of the renowned “Target Model” is proposed, coupled with the direct RES participation in the wholesale electricity market. In this way, Renewable Energy Sources and the competitive procedures through which they are currently installed are put in a bad light as supposedly responsible for the high process of electricity in Greece, as well as the “heavy” energy cost that many think is born by the Greek industries.

Are RES really responsible for electricity pricing?

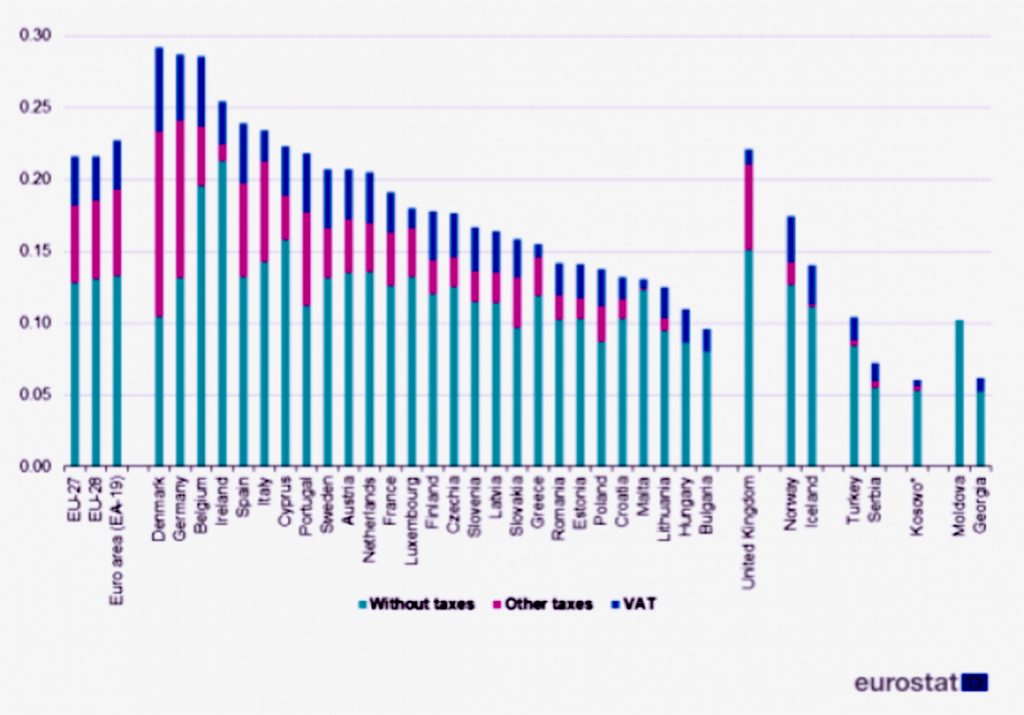

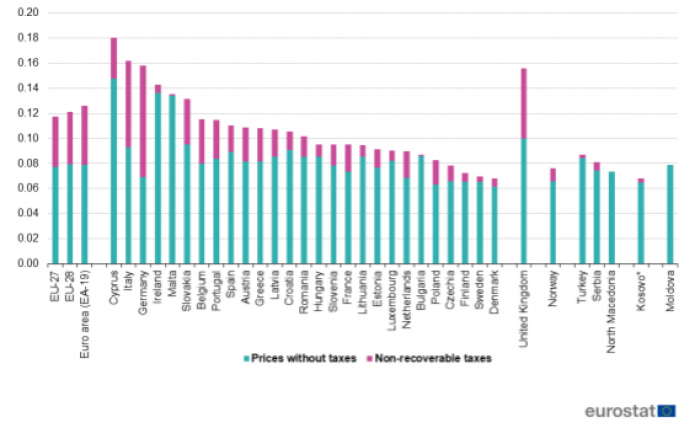

Greek consumers currently enjoy much lower electricity pricing than most citizens of other European countries. According to the official data published by EUROSTAT for 2H19, electricity price for a Greek household is way lower than those in Germany, Italy, France, Spain but also Slovakia, Slovenia and Austria.

It should be noted that with an average annual consumption of 4,000-8,000 kWh, households relatively represent the majority of the country’s consumption, holding a 33% share.

The picture remains the same even for non-household consumers in Greece, namely consumers with an average annual consumption of 500 – 2,000 MWh who represent a share of about 46% of the annual consumption. This category covers the vast majority of small and medium-sized businesses, agricultural entities and self-employed professionals. Electricity price in this market segment is also much cheaper than the European average and certainly much lower than in competitor countries. For instance, a medium to large hospitality establishment in this country has a clear competitive advantage – in terms of electricity – compared to its competitors in Italy, Spain or Malta.

RES compensation through regulated prices, whether centrally determined as in the past (tariffs), or deriving from competitive procedures as it is done today, is by no means a Greek phenomenon. It has been introduced by the European Union in an effort to change the mix of electricity generation to environmentally-friendly and climate-friendly fuels. Since RES technologies are inexpensive today, we sometimes witness RES resulting from tenders being compensated with prices that are equal, if not lower, than those thermal units in the wholesale energy market are compensated in Greece.

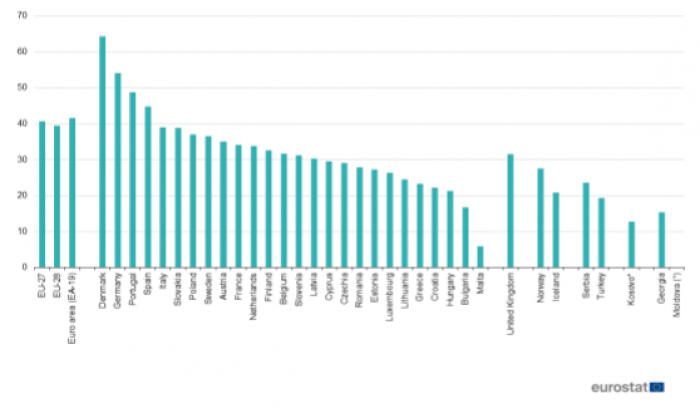

A significant part of the support provided to RES derives from the Special Charge for the Reduction of Gaseous Pollutant Emissions which in our country falls far short of the corresponding ones in most European countries. Charges and non-refundable taxes in Greece are overall well below the European average.

The very significant reduction of the above Charge for households and other low voltage uses by 25% (from 22.67 € / MWh to € 17.0 / MWh for households), applied retrospectively for the whole 2019, per the Ministerial Decision 76979/4917 / 31.8.2019, is worth noting.

Furthermore, it should be noted that while households and other Low Voltage consumers yield an approximate 75% of the total annual revenue from the above Special Charge, High and Medium Voltage industries (> 13 GWh) generate an insignificant 2%, while representing 20% of the total consumption in the country.

In conclusion, RES do not contribute to increased electricity bills as testified by official EUROSTAT data and the comparison to most European countries.

RES and the Greek wholesale electricity market

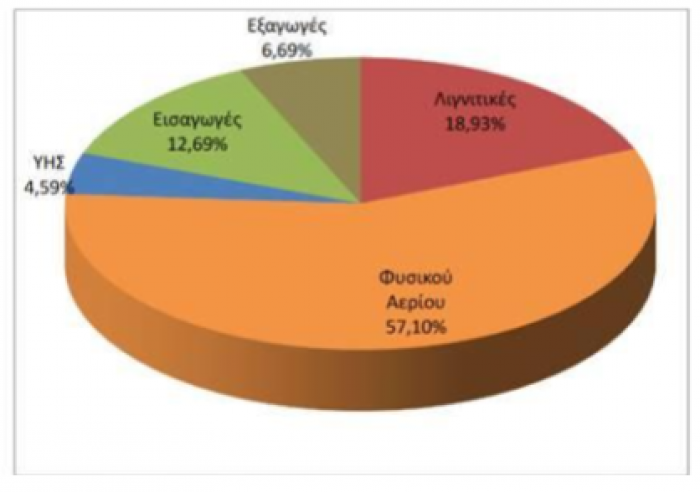

Pricing in the wholesale energy market is determined by its participants, namely the electricity producers who own thermal or hydroelectric power plants, the electricity traders who import or export energy and the suppliers.

Electricity price in the wholesale market gets traded for each day and time of day. As a result of the supply and demand, a price results in the end (System Limit Price). Not only RES do not participate in this process, since their energy is freely available but they are also compensated with the same price as a lignite fuel or gas electricity producer!

Gas units, lignite plants and imports determine wholesale electricity market prices.

However, while RES do not directly formulate pricing in the wholesale market, they indirectly contribute to its significant reduction, as testified by numerous reliable and independent studies (the National Technical University of Athens, Aristotle University of Thessaloniki, Foundation of Economic and Industrial Research, etc). Logical reasoning would suffice to testify to this: By participating in the market, RES contribute energy that would otherwise be contributed by polluting units. In this way, the share of the latter is reduced driving competition, therefore, generating reduced prices.

The current penetration of RES in Greece reduces the marginal System Price on average by about € 8/MWh resulting in around € 400 mil. annually, if multiplied by the total electricity consumption in the interconnected system (~51 TWh/year). That is to say, RES return about 50% of the Special Charge the Greek consumer has to pay today for their compensation.

To conclude, RES directly contribute to electricity prices reduction, which results in suppliers buying cheaper and therefore having the opportunity to pass on these lower prices to their customer’s (households and businesses) tariffs, due to increased competition and not their generosity.

The causes of the expensiveness in the Greek wholesale market of electric power shouldn’t be sought in RES but in other factors. Such are the mixture and quality of the Greek thermal production; the cost factors of this production (fuel, age of units, cost of rights); the faint presence of vertical players apart from PPC which could recover production costs from different markets; the currently limited international interconnections; the structure and regulation of today’s electricity wholesale market. In other words, a series of factors that are utterly irrelevant to RES and how these are compensated.

Industry

Both in Europe and Greece, as large end-users, industries are exempt from the RES aid cost. A domestic consumer, for example, currently pays € 17 for every 1,000 kilowatt hours he consumes, as a RES aid through the Special Charge. The respective industrial consumer included in the High-Consumption of high voltage category is charged with less than € 3.5; under the industry support system that has recently been introduced even less than € 1, exactly like competing industries elsewhere in Europe.

Moreover, large high-consumption industries, such as steel and metallurgy ones, regain the part of the energy cost that relates to pollutants generated by conventional power plants, from which they source energy.

What’s more, RES producers compensate industries with approximately € 50 mill annually for ceasing operations in case of increased electricity demand, i.e. Interruptibility Mechanism service, exclusively in Greece of all countries.

Competition between Industries and RES is not an issue anywhere in Europe or Greece. On the contrary, the European issue today is reducing greenhouse gas emissions deriving from industrial activity through multiple options, such as RES-using electricity, hydrogen use, carbon dioxide capture and, above all, energy efficiency and energy saving.

By M. Verriopoulos and N. Vasilakos

*Michalis Verriopoulos is a Civil Engineer and former Secretary General of Energy and Mineral Raw Materials

*Dr Nikos Vassilakos is a Chemical Engineer and former Chairman of the Energy Regulator Authority